DOWNWARD SLOPING DEMAND CURVES FOR STOCK AND LEVERAGE

:

:

https://doi.org/10.9744/jmk.8.2.pp.%2078-94

Keywords:

slope of demand curves for stocks, leverage, financing decisions.Abstract

This research attempts to investigate the effect of downward sloping demand curves for stock on firms' financing decisions. For the same size of equity issuance, firms with steeper slope of demand curves for their stocks experience a larger price drop in their share price compare to their counterparts. As a consequence, firms with a steeper slope of demand curves are less likely to issue equity and hence they have higher leverage ratios. This research finds that the steeper the slope of demand curve for firm's stock, the higher the actual leverage of the firm. Furthermore, firms with a steeper slope of demand curves have higher target leverage ratios, signifying that these firms prefer debt to equity financing in order to avoid the adverse price impact of equity issuance on their share price.Downloads

Published

2007-02-06

How to Cite

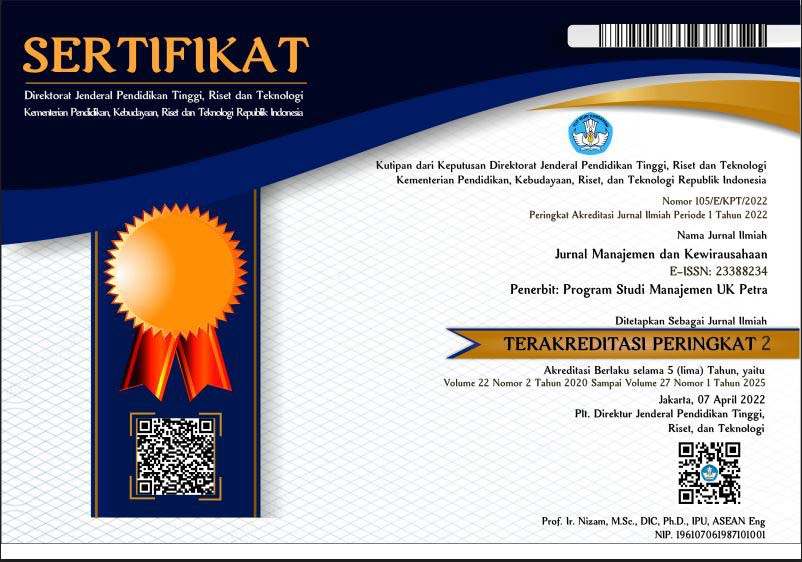

Liem, P. F. (2007). DOWNWARD SLOPING DEMAND CURVES FOR STOCK AND LEVERAGE. Jurnal Manajemen Dan Kewirausahaan, 8(2), pp. 78-94. https://doi.org/10.9744/jmk.8.2.pp. 78-94

Issue

Section

Articles

License

Authors who publish on this journal agree to the following terms:

- Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution License that allows others to share the work with an acknowledgement of the work's authorship and initial publication in this journal.

- Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the journal's published version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgement of its initial publication in this journal.

- Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See The Effect of Open Access).